Everybody wants to enjoy a certain level of wealth and success in life. But so few of us actually manage to create the life of ease and abundance that we long for.

So why is that? Well, one big reason is that we don’t cultivate a healthy relationship with money. We develop beliefs, attitudes and habits about money in our youth that hold us back from being able to generate wealth and enjoy the financial freedom we desire.

But the good news is, once you’re able to identify these “money roadblocks” in your own habits and behaviors, you’ll be able to overcome them once and for all — and finally be able to make more than enough money to create the life of your dreams.

So today I’d like to talk about five big obstacles that are keeping you from experiencing the wealth and success you deserve and the solutions to overcoming them.

Roadblock #1: Self-Limiting Beliefs

The first roadblock to wealth is any self-limiting beliefs you might have about money. Perhaps, as a child, you were encouraged to believe ideas like, “There’s never enough money to go around.” “Money doesn’t grow on trees.” “Wanting a lot of money is selfish.” Or even, “Money is the root of all evil.”

These childhood beliefs can hinder your adult financial success. If you think that money is evil, and that wanting a lot of money is selfish, you will be far more likely to avoid opportunities to make more money.

And if you think there’s never enough money to go around, you’ll be more likely to throw your money away on frivolous purchases — because who knows when you’ll ever get the chance again?

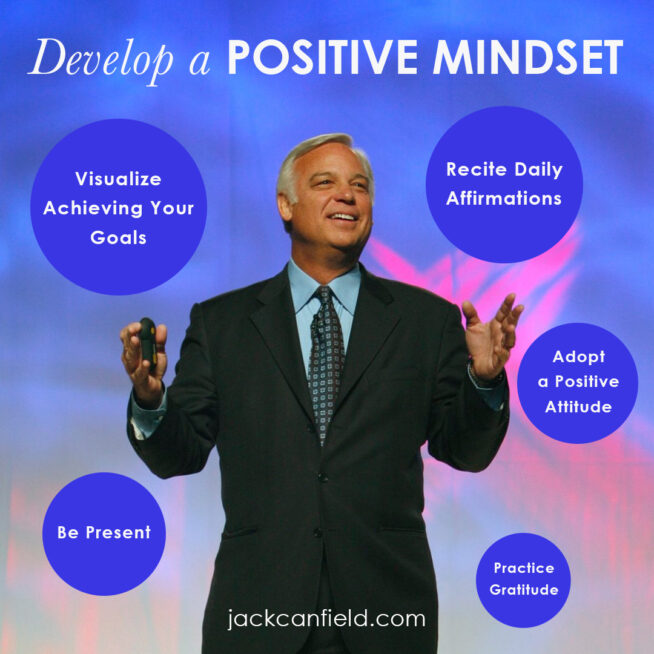

Shift Your Mindset

If you want to achieve financial freedom, the first thing you need to do is some mindset work to change the way you think about money.

Here’s a simple process to help you do this. First, write down your limiting belief in your journal or notebook. For example, your limiting belief might be, “True artists don’t care about money.” Or, “I don’t deserve to be wealthy.” Be honest with yourself and identify exactly what beliefs you have and how they make you feel.

Once you’ve written down your negative belief, write down all of the reasons why it’s not actually true. For example, “Many artists have achieved great wealth in their lifetime.” Think of Picasso and David Hockney and singer-songwriters like Leonard Cohen, Paul McCartney and Kendrick Lamar.

And replace your negative belief with the fact, “People are willing to pay good money for art they love.” I know I have spent $20,000 on a piece of art, and others have paid millions.

Or take on the new belief, “I am a good person who devotes so much of my time to helping others,” and “I deliver a lot of value and am always ready to do whatever it takes to get the job done well.”

Use Affirmations

Repat your new beliefs as affirmations to yourself several times a day to shift your consciousness around money. You can also print them out and post them on your bathroom mirror, your refrigerator and next to your computer.

Finally, write a positive turnaround statement that is the opposite of your original belief, and is based on the reasoning you used in step 2. For example, instead of saying: “True artists don’t care about money,” say, “I am a true artist, my art is valuable, and I deserve to be paid good money for it.”

Or instead of saying, “I don’t deserve to be wealthy,” say, “I am a good person who works hard and cares about others, and I deserve all the money I desire.” Then repeat this new belief to yourself several times a day for at least thirty days. This is a powerful way to create a much more positive and powerful money mindset.

Roadblock #2: Having One Source of Income

The second big roadblock that holds people back from making more money is relying on a single limited source of income.

For example, if you have a job or a career that doesn’t pay much and offers little opportunity for growth, and that’s your only source of income, you’re going to find it a lot more challenging to accumulate wealth.

So, you should either get the training you need to be compensated for a higher-paying job … or develop multiple streams of income to generate more wealth.

For instance, let’s say you’re a high school teacher. You’re going to find it very challenging to become a millionaire or a multimillionaire if you rely on your teacher’s salary as your only source of money. That’s not to say you can’t become a millionaire.

You could choose to run a lucrative side business in the summer, or invest in rental properties, or learn how to manage and invest your money extremely effectively.

You could also join a network marketing company and supplement your income through direct selling and enrolling people in your downtime in the evenings and on the weekends.

There are any number of ways you can grow wealth. And if you want financial freedom, you should explore every option and develop a number of different income streams that allow you to accumulate the wealth you desire.

Roadblock #3: Financial Illiteracy

The third roadblock to wealth and success is financial illiteracy. By that, I mean you simply don’t know what it takes to make, manage and grow your money. This is essential information if you want to be wealthy.

If you want to be a baker, you have to learn how to bake bread and pastries. You have to know exactly what to do with the flour, the salt, the yeast and so on.

If you want to be wealthier, you have to learn how to make, manage and grow money. You have to know what to do with your paychecks, your bills, your savings account, your investments and so on.

One of the cornerstones of financial literacy is knowing how to develop — and stick to — a budget.

Budgeting allows you to track your money: where it comes from, where it goes and how much you spend on all of your monthly expenses.

This is super important because it makes it easy for you to identify areas where you’re spending too much, so you can stop overspending and invest that money in your future instead.

Also make sure to set weekly, monthly and yearly financial goals for yourself — in terms of how much you earn, spend, and save. When you have clear goals, you are way more likely to plan for them and achieve them.

Also, teach yourself the power of compound interest. If you make a loan or deposit, compound interest is the money added to the original principal sum of your investment.

Rather than taking out your interest and spending it, you can simply reinvest it to earn even more interest, as the overall invested amount becomes larger and larger.

Roadblock #4: Debt

The fourth roadblock to wealth is debt. Most of us in America, and in many other developed countries around the world, are carrying way too much debt.

The interest we pay on that debt, not to mention the pressure of all that money needing to be paid back, robs us of our ability to generate lasting wealth.

So if you want to be wealthy, your first priority should be to clear up your debt and stop paying all that unnecessary money in interest to banks and credit card companies.

You also need to learn the difference between good debt and bad debt. Good debt is debt that is taken on to improve your future in some significant way. For example, buying a property that is sure to grow in value over time.

Bad debt, on the other hand, is debt that doesn’t advance your future in any way, but only costs you money. For example, overspending on your credit card or buying a brand-new car you can’t afford, and then having to make high monthly payments on it for years to come.

Roadblock #5: Not Asking for Money Advice

Finally, the fifth roadblock I see holding people back from generating more wealth and success is discomfort over asking for money advice. Most of us are afraid to ask others for advice around money.

We feel like it’s something we’re supposed to know, and we’re embarrassed to admit that we don’t. And so we never reach out and ask for the help we need.

But you really need to get this. It’s okay to ask for help! There are people all around you who would be more than happy to give you the advice, and counsel you need to manage your money more effectively.

Any financial advisor at your bank would be more than happy to meet with you, review your financial situation, and give you some free advice on how to grow your wealth.

Or, if you know any wealthy people at work or socially, you could take them out for lunch and ask them to give you some tips on managing your money.

Most people would be more than happy to help. And rather than looking down at you, they will be impressed by the initiative you’re showing.

Overcome Your Roadblocks to Wealth and Success

Ultimately, the ability to accumulate wealth and success is in your hands.

Anyone can make money, no matter where they are at in life. But it takes a positive money mindset, the willingness and commitment to learning what you need to know, and then the action on your part to make it happen. Are you ready to get started on your journey to greater wealth?

It’s time to apply the solutions to the five roadblocks to wealth and success. Here’s a recap of how to get started:

- Identify and replace any self-limiting beliefs about money that you might have

- Create more than one source of income.

- Become financially literate by learning what it takes to make, manage and grow money.

- Get out of debt.

- Ask for money advice.

Having a positive mindset goes a long way in helping you overcome obstacles and reach your financial goals. My Affirmations for Success Guide can help you replace your limiting beliefs and achieve the success you’re looking for. Download a free copy today.

And remember, nothing in your life will change for the better until you do.

As the beloved originator of the Chicken Soup for the Soul® series, Jack Canfield fostered the emergence of inspirational anthologies as a genre—and watched it grow to a billion dollar market. As the driving force behind the development and delivery of over 100 million books sold through the Chicken Soup for the Soul® franchise, Jack Canfield is uniquely qualified to talk about success. Jack is America’s #1 Success Coach and wrote the life-changing book The Success Principles: How to Get From Where You Are to Where You Want to Be and Jack speaks around the world on this subject. Check out his newest book The 30-Day Sobriety Solution: How to Cut Back or Quit Drinking in the Privacy of Your Own Home. Follow Jack at www.jackcanfield.com and sign up for his free resources today!

Image courtesy of TUBARONES PHOTOGRAPHY.